Schedule E Irs 2024 – the IRS said Tuesday that it is delaying the e-filing requirement. The IRS announced in Notice 2024-26 that U.S. withholding agents are administratively exempt from the e-filing of Form 1042 required . It’s tax season again. You’ve gathered your W-2s, 1099’s and other pertinent information, completed your tax return and filed it. If you’re owed a refund, now all you have to do is wait. But how long .

Schedule E Irs 2024

Source : www.inkle.ioIRS Refund Schedule 2024 When To Expect Your Tax Refund

Source : thecollegeinvestor.com2024 IRS Refund Schedule, E File & Paper Filing Dates

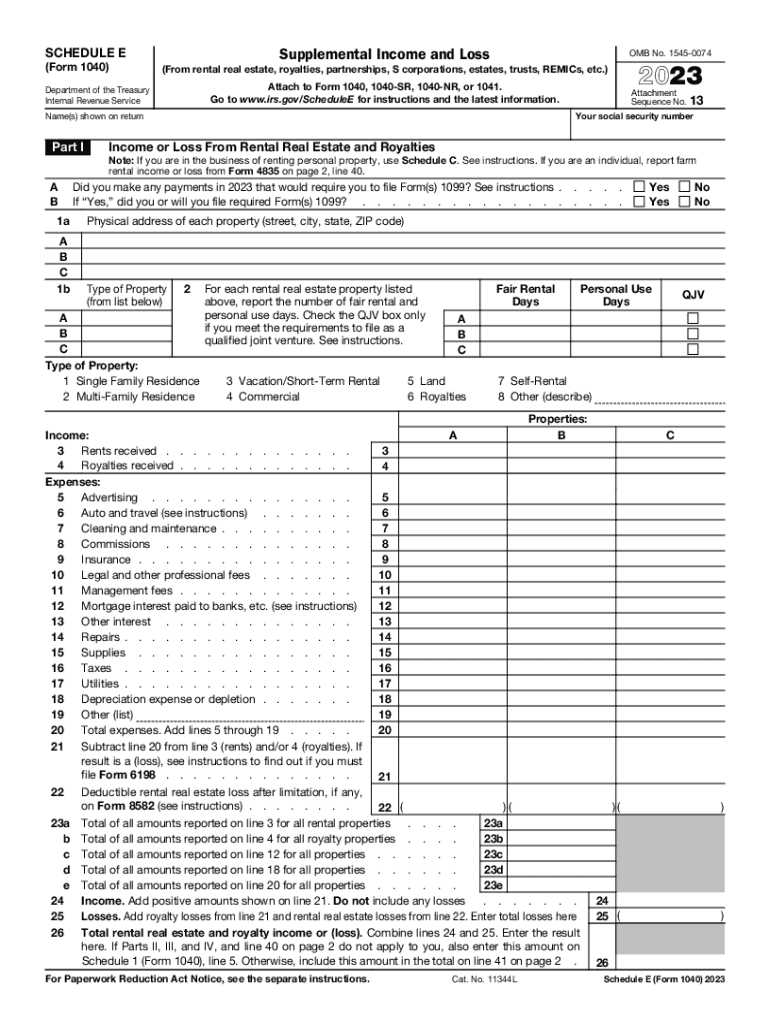

Source : www.inkle.io2023 Form IRS 1040 Schedule E Fill Online, Printable, Fillable

Source : irs-form-schedule-e.pdffiller.comRefund schedule 2023 : r/IRS

Source : www.reddit.com2023 Form IRS 1040 Schedule E Fill Online, Printable, Fillable

Source : irs-form-schedule-e.pdffiller.comMastering Schedule E: Tax Filing for Landlords Explained

Source : www.turbotenant.comIRS 1040 Schedule E 2003 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comSchedule E Instructions: How to Fill Out Schedule E in 2024?

Source : www.noradarealestate.comIRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

Source : money.comSchedule E Irs 2024 2024 IRS Refund Schedule, E File & Paper Filing Dates: You can see the status beginning around 24 hours after you file your current-year return, according to IRS.gov. You can also see your e-filed prior-year return within three or four days, and your . The IRS finally made it through a backlog of tax returns caused by COVID 19-related delays. The agency had a backlog of about 17 million paper-filed Form 1040 tax returns at the close of the 2021 .

]]>